Applying card controls allow SMEs to have control on where and just how calling card are made use of by employees. Choices around blocking seller groups or perhaps establishing limits and notifies can enable companies to keep an eye on card use. Making It Possible For Digital Pocketbook is yet one more capacity that can make the total experience smooth as it can remove any type of requirement to bring a physical card.

Alleviate of Repayments

Managing capital is critical for small business and no person likes to await 2-3 functioning days for a payment to appear in their account. Financial institutions ought to check out making the real time settlements platform, NPP, readily available to their company customers. It can at the very least enable them to receive funds in realtime as well as make payments to their distributors in real-time offered their bank has actually enabled NPP too. Also several of the batch repayments processing such as Payroll processing can be carried out in real-time with NPP. Cross boundary repayments via digital channels is a basic offering across banks and also the Financial Institutions collaborating with the SME segment must guarantee that this is not a feature void as it supplies the SME clients the ease to deal with international transactions. Companies like TransferWise are offering borderless accounts as well as supplying such capacities can transform the experience of SMEs with international supply chain.

Information Reporting and Insights

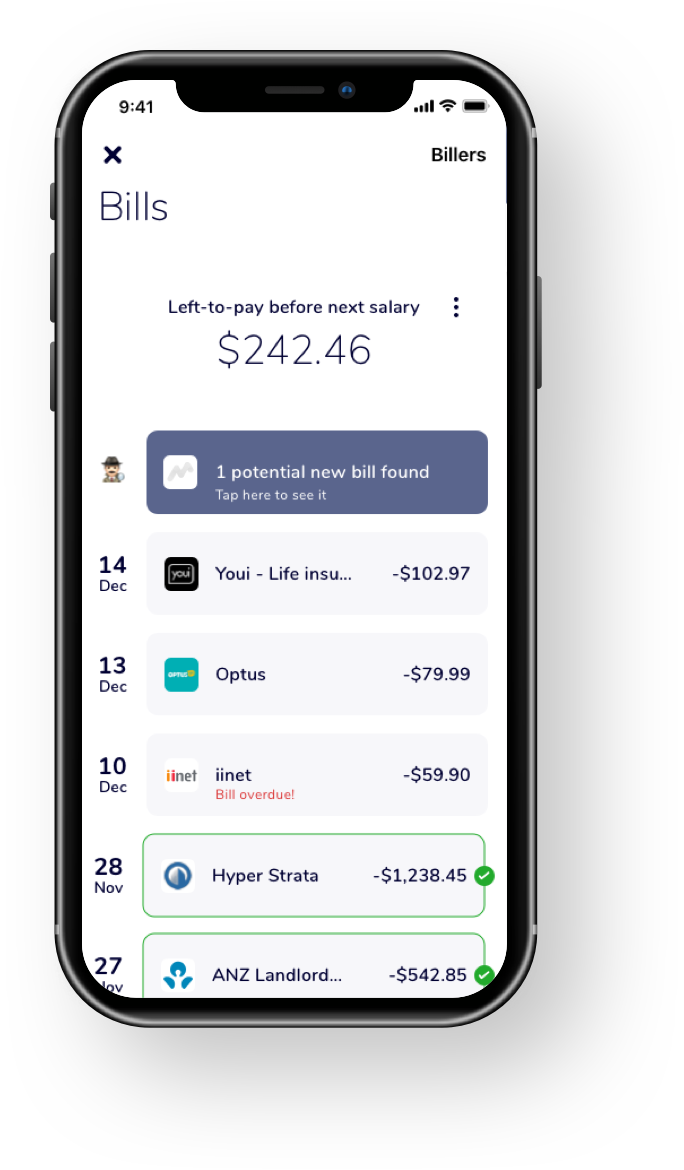

Financial institutions have a full view of deals of their consumers as well as with open financial they can additionally launch consent to obtain details of financial purchases with various other banks. This information can not just supply useful understandings to financial institution in case they are doing any credit score evaluation of their client, it can also allow them to supply meaningful reports to their customers. Banks can construct or acquire devices or leverage fintech partnerships that can allow SMEs to better understand their financial setting such as income, expenditure and various other operational indications. Categorisation of deals can offer them a viewon the type of expenses and also enable them to optimise/ control if they are checking out expense control. The digital channels such as mobile application and also online banking can

give financial health signs to the consumers in the form of dashboards and significant reports.

Digital Invoicing

Based on a current record from VISA on "Digital improvement of SMEs: The Future of Commerce", digital invoicing has actually been highlighted as an area of eager rate of interest for SMEs, giving a route for earnings to be obtained from customers and also for vendors as well as vendors to be paid in order to, ' maintain the lights on'. The report highlighted that throughout SMEs, there is agreement that sending and also getting electronic billings gives substantial benefits such as, 80 percent of respondents agreed that the expense of sending out invoices is minimized compared to paper invoices (e.g. saving money on paper, printing and also shipping), and also 82 per new banking technology

cent also agreed that there are time savings. Vitally, 78 per cent of SMEs rather or strongly concurred that they obtain cash faster from customers using electronic billings, contrasted to paper.

While some of the significant services can consider third party software such as Xero to send digital invoices, there are still a big collection of local business or micro-businesses that can latch-on any type of offerings supplied by their Banks. This capability can be provided by financial institutions either via inhouse growth or leveraging the capabilities of fintech companions. Financial institutions can better take a look at embedding the experience as part of electronic channel experience, as an example in-app invoicing.